Discover 4 Key Benefits of AI in Treasury Management

Step into the Future with AI in Treasury

With the rapid evolution of artificial intelligence (AI), AI is no longer a future concept—it’s here, and ready to be implemented in treasury operations.

Now, finance leaders are wondering, “How do we use AI safely in treasury management?”.

That’s a question Bob Stark, Kyriba’s Global Head of Enablement, recently answered in a presentation at 2024’s Kyriba Live Exchange (KLX). The event was held in Singapore to celebrate Kyriba’s expansion growth throughout the Asia Pacific (APAC) region.

To start, he reviewed the evolution of AI in treasury management technology.

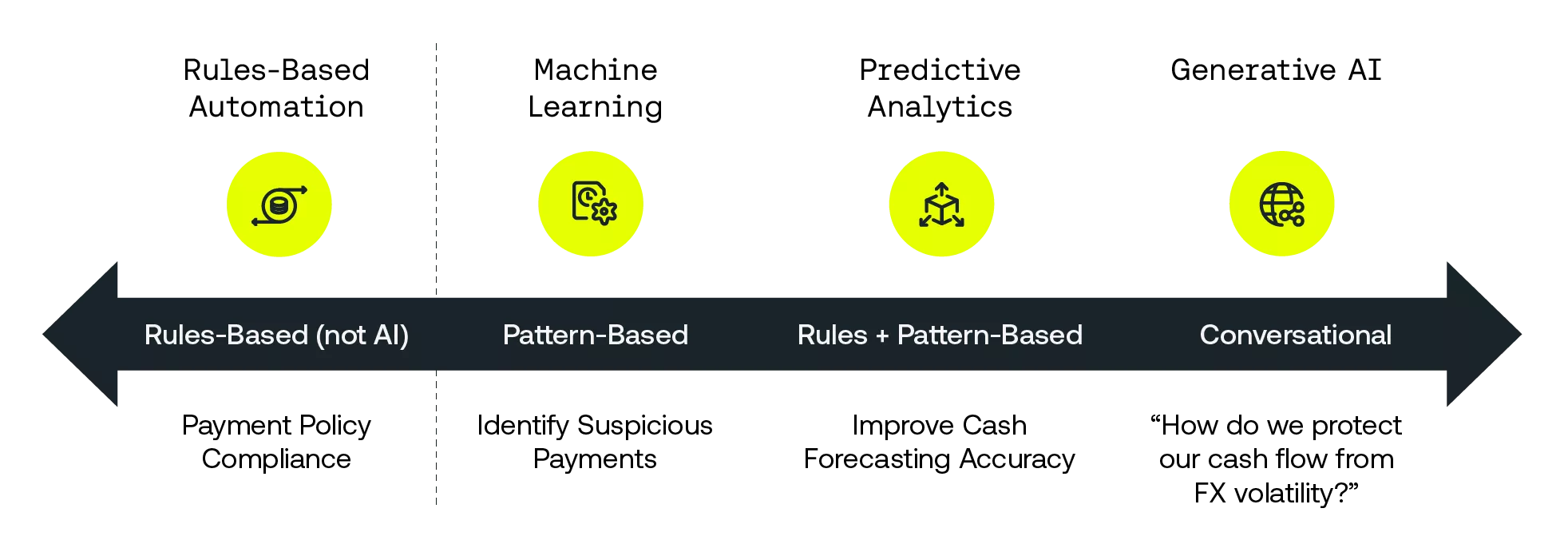

The Evolution of AI in Treasury Management Software

Stage 1: Rules-Based Automation

Initially, there was rules-based automation. With this technology, the treasury system, ERP, and spreadsheets respond automatically based on a set of rules. It was perfect for use cases such as payment policy compliance but, it couldn’t learn from errors or adjust to new information and scenarios.

Stage 2: Machine Learning

Then the evolution continued, with machine learning, which is essentially pattern-based recognition. It answers questions like, “Is this a good payment, or is it not?” It’s perfect for identifying suspicious payments.

For example, the technology gets trained on a data set that includes examples of secure, successful transactions. Then, it uses that learning to determine whether new transactions fit the definition of a “good” payment. It can’t say what makes something a bad transaction exactly (that will come later in AI’s evolution), but it can say that this is good, and that this is not good. It’s a very binary type prediction, but one that can be useful in the world of treasury management and preventing fraud.

Stage 3: Predictive Analytics

Building on machine learning, predictive analytics combines rules with advanced data analysis, for enhanced accuracy in decision-making. This is particularly useful for improving cash forecasting accuracy or optimizing hedging strategies.

Now, the technology can say not only whether or not something is a good payment, but it can provide an amount and date to forecast, or recommend a hedging decision.

Stage 4: Generative AI

At last, generative AI arrives. This conversational technology uses all of the data available, from multiple systems, to answer complex, business-critical questions like, “How do we protect our cash flow from FX volatility?” And, it can perform complex tasks, such as:

Searching for transactions and data to answer a question

Generating procedures and documentation, or translating them into different languages

Writing programs and processes, including payment scripts

Creating new reports in Excel

There Is No AI Strategy Without a Data Strategy

Clearly, there is a lot to be excited about with generative AI. But, every AI strategy must first start with a data strategy. The Office of the CFO must ask questions around data collection, access, and governance:

What data do we want to use to train our models?

Who owns and maintains the data?

How will we protect sensitive data, in alignment with our information security policies?

Which platforms and integrations will we use to manage, synchronize, and disseminate our data?

The Three As of an AI-Powered Treasury Solution

To fully harness AI, organizations must embrace what Kyriba likes to call the Three As of a robust treasury solution: APIs, AI, and analytics.

APIs unify data across the enterprise (including banks, ERPs, portals, and apps) to provide a reliable stream of real-time information.

AI drives intelligent predictions and enhances data usability.

Analytics transform data into actionable insights.

Just as an AI strategy cannot work without a data strategy, AI does not work without APIs. APIs provide the massive, real-time data streams AI needs to make accurate and reliable predictions. Organizations that understand this are significantly increasing their data capabilities to enhance the accuracy and confidence of their AI-driven insights.

4 Use Cases of AI in Treasury Management Today

Here are four examples where AI is already being used in treasury management today.

AI in Treasury Use Case #1: Payments Fraud Prevention

Rules-based technology only knows the information it was trained on. It has no context or awareness for the next big thing in fraud, from deepfake AIs to linguistically complex phishing emails. As a result, it cannot detect unknown types of fraud attempts.

However, AI excels in payments fraud prevention by learning and adapting. AI compares payments with historical data to recognize what’s normal and predict what’s abnormal. And with each new transaction, it gets smarter, because it has a growing set of data to work with.

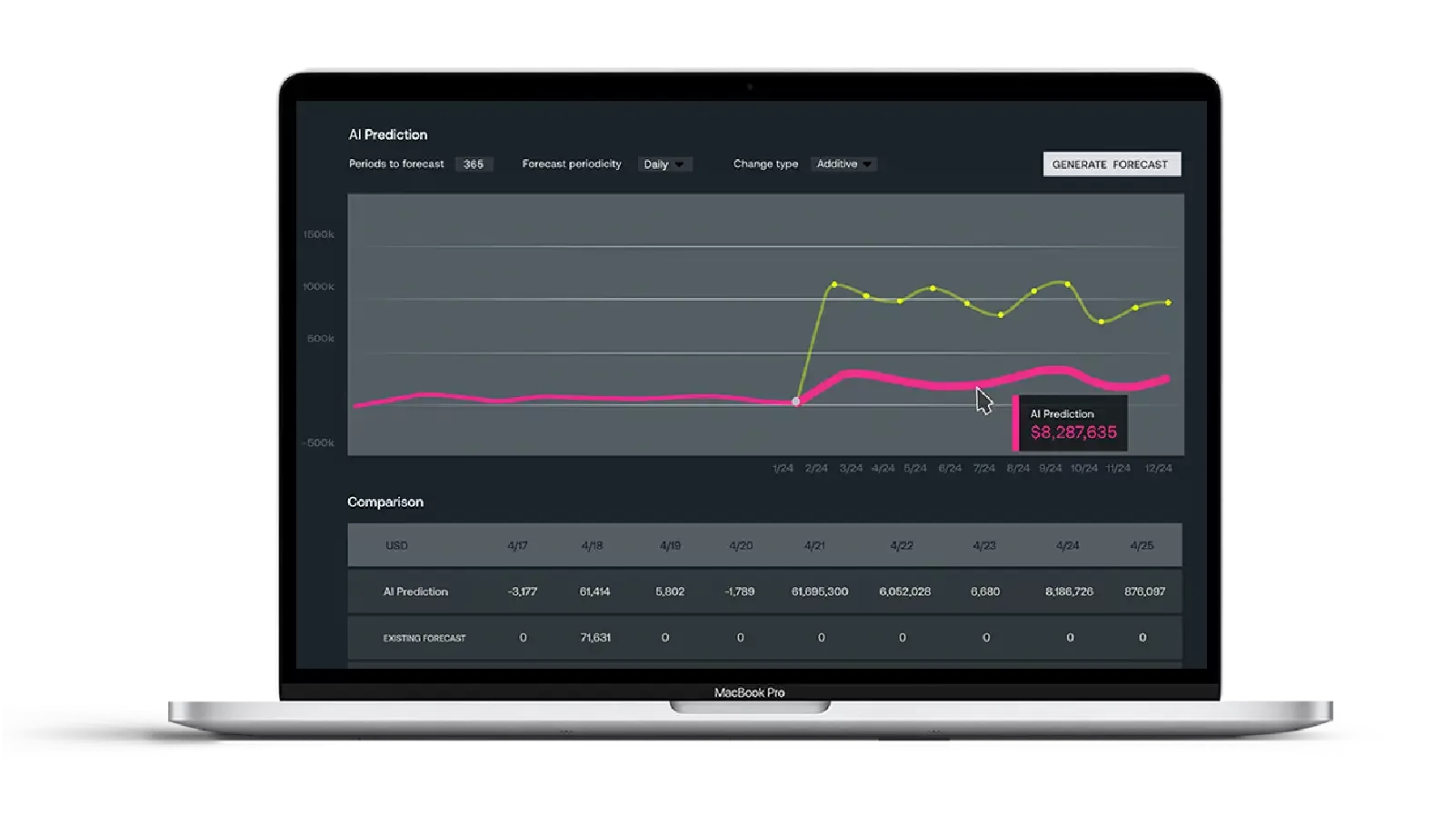

AI in Treasury Use Case #2: Improve Cash Flow Forecasting

AI can improve overall forecast reliability because it analyzes historical payment patterns. It learns from prior forecast changes (e.g., late or short payments) and combines that information with other forecast sources to predict a more accurate amount and timing of cash flow versus existing forecast.

But what about when there is no history for a particular scenario? This may be the case for organizations that are:

Engaging in M&A

Divesting part of the organization

Entering a new market

This is where generative AI comes in. When forecasting new scenarios, where no historical data exists, the “creativity” of GenAI identifies new data to learn from so it can answer questions like, “What's the cash flow impact if we expand into this country, or divest part of our business?”

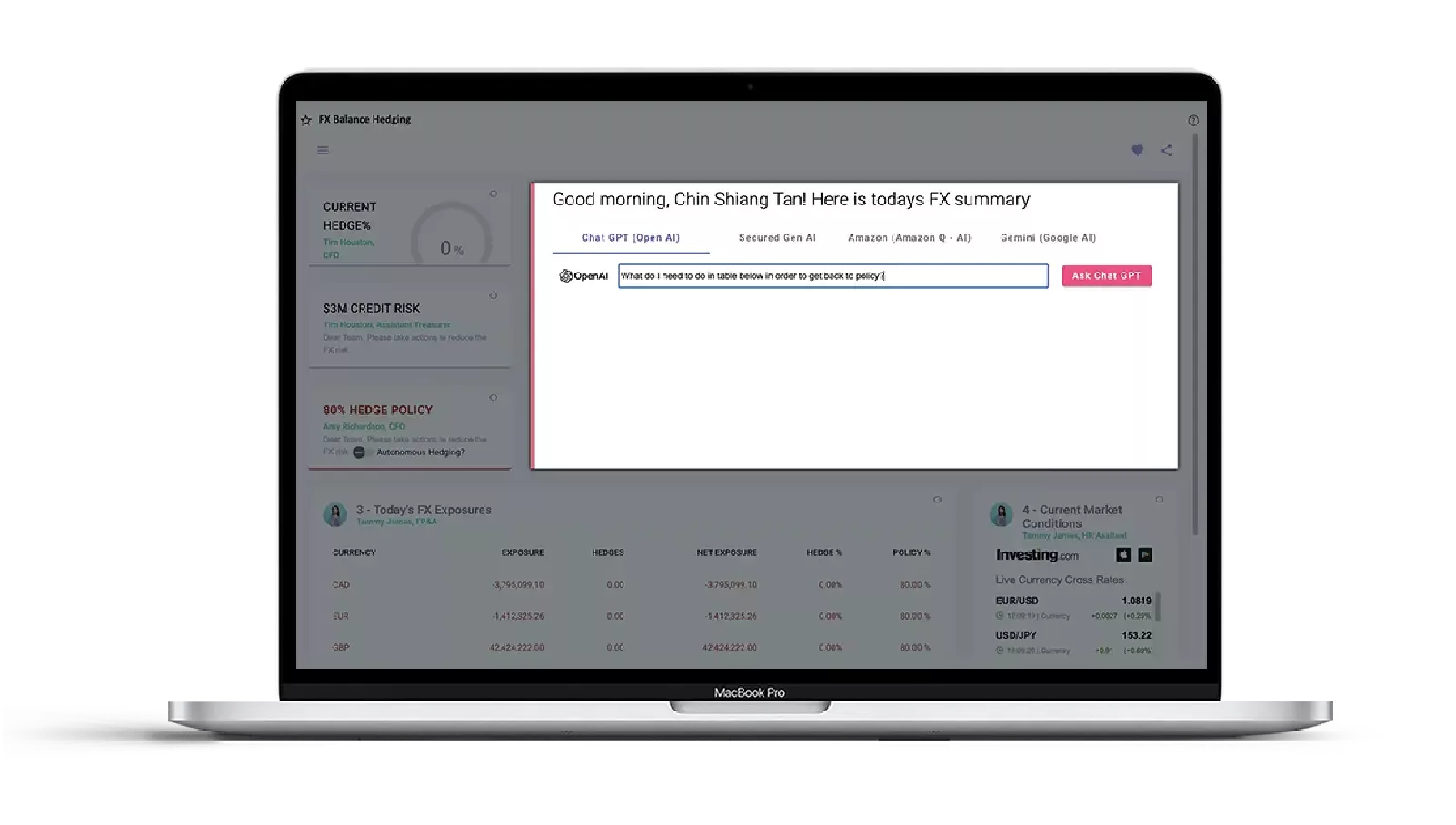

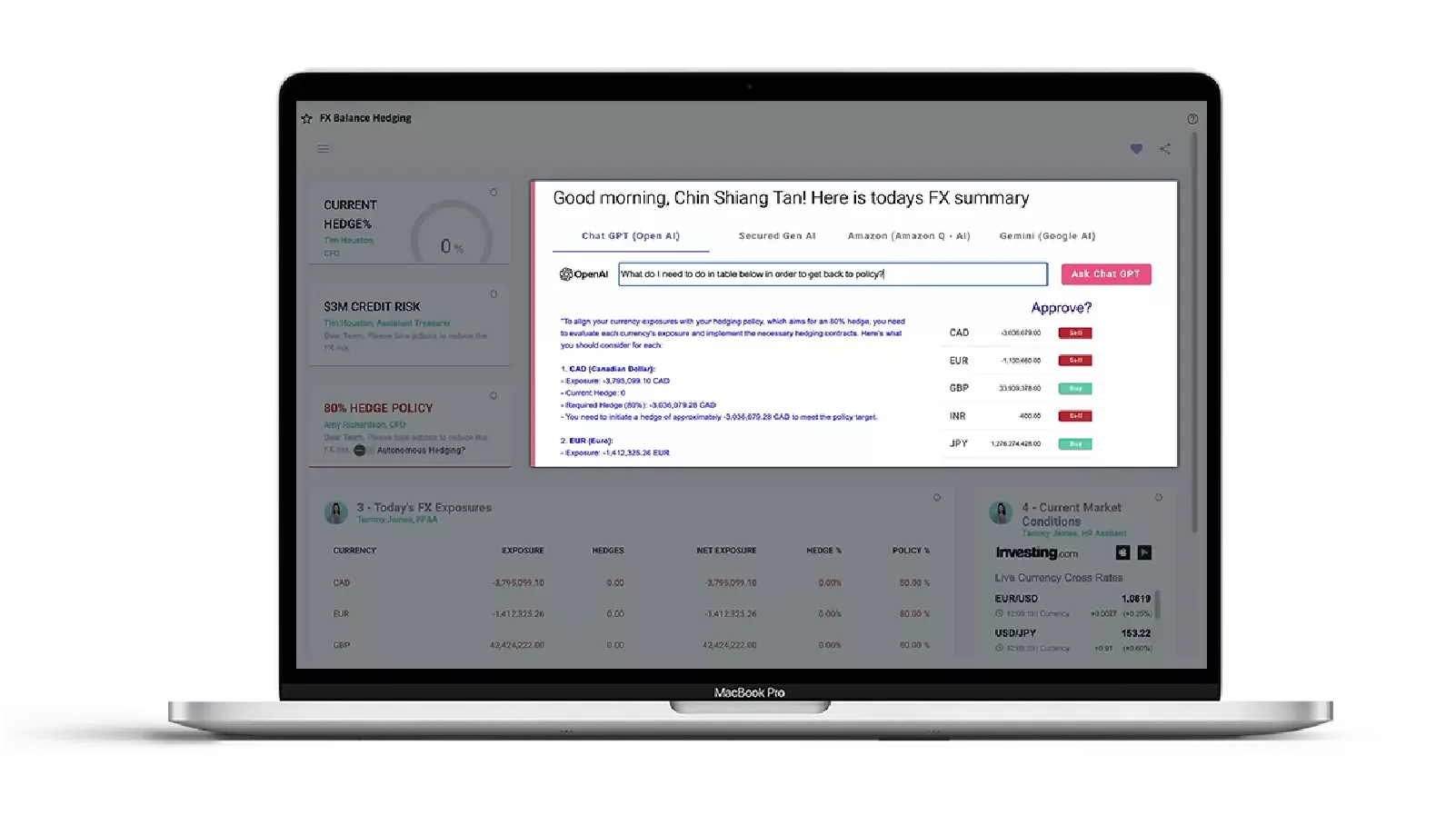

AI in Treasury Use Case #3: Optimize Cash Flow Hedging

Generative AI can analyze multiple data sets to provide insights into optimal hedging strategies, based on existing exposures and desired outcomes. For example, finance leaders can ask AI how to adjust their hedging in order to:

Make a new policy

Reach a certain P&L

Improve the effectiveness of your hedge based on a certain budget

Provide the tool with FX exposures and existing hedges, and generative AI will provide the answer.

AI in Treasury Use Case #4: Use the Kyriba Excel API to Get All Kyriba Data in Your Spreadsheet

Combined with tools like the Kyriba API and Microsoft Copilot, AI facilitates faster, more efficient report creation, enabling better decision-making.

Log into the Kyriba API from Excel to access all the data that you need.

Use ChatGPT to make data requests, such as “What do exchange rates look like over the next 7 days?”

Spin up a report with Microsoft Copilot. Ask it to make a table, create a spreadsheet, or perform a VLOOKUP.

Together, these tools provide everything you want from a spreadsheet, but without all the time it used to take to do it.

AI is an Assistant, Not a Replacement

AI is a powerful tool that complements human intelligence, enhancing data-driven decisions and improving operational efficiency. It functions as a copilot empowering finance leaders to make better predictions, safeguard payments, and project cash flows.

Looking for more insights on AI?